As new waves of tariffs and trade disputes make headlines once again, many Canadians are wondering what this means for their investments and long-term financial plans.

The short answer? Volatility brings both risks and opportunities, and a thoughtful, diversified approach can help you make the most of both.

What is currently affecting the markets?

Recent developments between the world’s largest economies have reignited global trade uncertainty. From renewed U.S.–China tariff measures, to policies targeting key materials like softwood lumber, rare earths exports and vehicle components, these shifts can affect everything from manufacturing costs to consumer prices.

How does this affect me as a Canadian investor?

For Canadians, the impact can feel indirect, but not invisible. Tariffs influence the cost of imported goods, the profitability of export industries, and potentially, the performance of your investment portfolio.

How can I safeguard my portfolio?

🛡️ Look to sectors that tend to withstand tariff volatility

History offers helpful perspective. During previous periods of tariff disputes, some areas of the market demonstrated greater stability than others. Maintaining some exposure to these sectors can help smooth returns when global markets turn unpredictable:

Essential and defensive industries - Utilities, telecommunications, and consumer staples often maintain steady demand even when trade slows down.

Domestic-focused companies - Businesses that rely primarily on Canadian or North American supply chains may face less tariff exposure and steadier earnings.

Infrastructure and real assets - These often serve as inflation hedges when tariffs push up input prices.

Commodities and resource producers - Select energy and materials holdings can benefit if trade policies drive commodity price increases.

🎯 Consider these investment strategies

Whether you invest independently or with professional guidance, the most effective strategy during times of uncertainty is to focus on what you can control. Consider these approaches:

Diversify geographically - Reducing reliance on any single region can limit tariff-related risk.

Focus on quality and dividends - Companies with solid balance sheets and a track record of paying dividends tend to remain resilient during market swings.

Maintain liquidity - Keeping part of your portfolio in liquid assets allows flexibility to take advantage of opportunities that arise in volatile markets.

Think long term - Trade policy headlines often cause short-term reactions. Staying focused on long-term goals helps prevent emotional decisions.

🧭 Take a broader view of your finances

Tariff changes don’t just influence markets, they can also affect your overall financial picture. Here are a few ways to keep your plan on track:

Review your household budget - Tariffs can lead to higher costs on imported goods, which may impact everyday spending. Adjusting your budget helps protect your savings goals.

Revisit your long-term projections - Market fluctuations tied to trade tensions can temporarily affect portfolio growth. Updating your financial plan ensures that your retirement and investment timelines stay realistic.

Stay proactive with cash flow - Keeping a portion of funds easily accessible provides flexibility to manage unexpected expenses or take advantage of new opportunities.

Consider professional guidance - Regular reviews with a wealth manager can help you identify risks early and make informed adjustments as global conditions evolve.

Charting the path ahead

Trade disputes and tariff shifts are not new, but they do create fresh challenges, and opportunities, for investors. Staying diversified, maintaining perspective, and seeking qualified advice are key to navigating these periods of uncertainty with confidence.

Questions?

If you have any questions about this article, are interested in a free portfolio review, or just want to know more about the services we offer, please contact one of our Wealth Management Experts or complete the contact form below.

CONTACT US

You may also like...

View all news

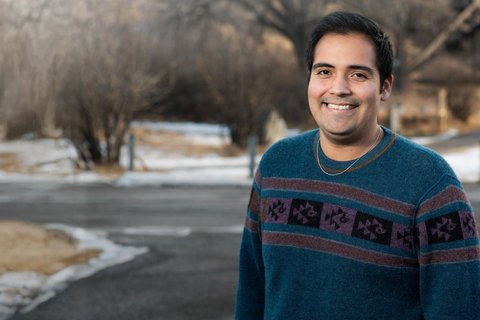

Congratulations to Daniel Denegri on earning his CPA designation

Join us in recognizing this significant moment in Daniel’s professional journey.

Congratulations to Sara Barfuss on earning her CPA designation

Join us in celebrating this meaningful step forward in Sara’s career.

Congratulations to Carissa Vandenhoek on earning her CPA designation

Join us in congratulating Carissa Vandenhoek on this well-earned achievement.

Free Consultation

Have questions? Book a free consultation. It's really just a casual conversation where we try to learn more about you and your goals, and how we can help you achieve those.